AAA Travel Insurance - 2024 Review

AAA Travel Insurance

6

Strengths

- Strong Insurance Partner

Weaknesses

- Very Expensive

- Weak Benefits

- Insufficient Travel Insurance Cover

Sharing is caring!

AAA Travel Insurance

Many AAA members would like to know whether AAA Travel Insurance offers good value for the price. The short answer is no. AAA Trip Insurance is expensive and has very weak travel medical benefits. AAA Travel Insurance customers would be well advised to compare the market, for better coverage and lower prices.

Some of our staff, like millions of Americans, are happy AAA members. The AAA benefits themselves are often enough to justify the annual premium.

AAA Travel Insurance – Provided by Allianz

AAA Travel Insurance is provided by Allianz Global Assistance. AAA offers several different travel policy types through its relationship with Allianz. Allianz Global Assistance is part of the Allianz Group and is one of the world’s largest insurers. Its Global Assistance team is one of the most respected in the travel insurance industry.

Allianz also provides many travel insurance policies for airlines and other travel suppliers.

AAA Travel Insurance – Single Trip Protection Plans

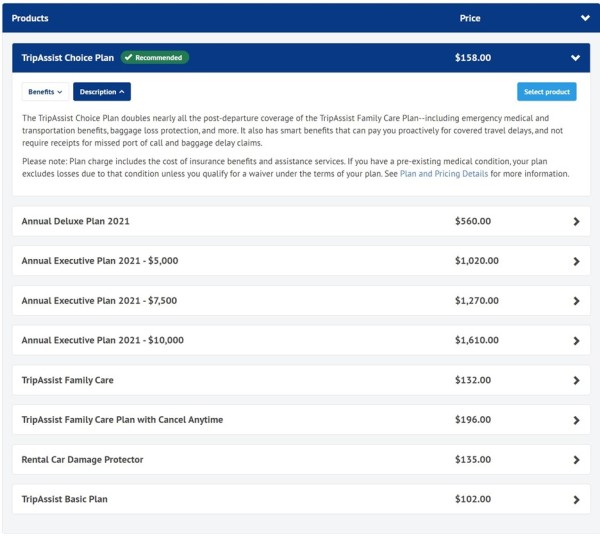

AAA provides several types of travel insurance; however, most travelers are primarily interested in single trip insurance. AAA offers four different single trip plans, called ‘TripAssist’ - Basic, Choice, Family Care and Family Care with Cancel Anytime.

TripAssist Basic

This is great for weekend getaways and overnight trips as it includes trip cancellation and trip interruption along with medical and medical evacuation coverage.

This plan provides $10k in medical coverage and $50k in medical evacuation coverage, which may be adequate for domestic travel as US healthcare can provide coverage as well. However, this would be too low if traveling internationally (including travel to Canada and Mexico). Another consideration is the out-of-network costs when traveling domestically but out-of-state. Using an out-of-network provider or hospital may be more expensive than anticipated. Before traveling domestically, be sure to check your health insurance coverage for these costs.

The $50k for Emergency Medical Transportation is sufficient for travel within the USA, but we would not be comfortable with this level of coverage for international destinations and would recommend at least $250k.

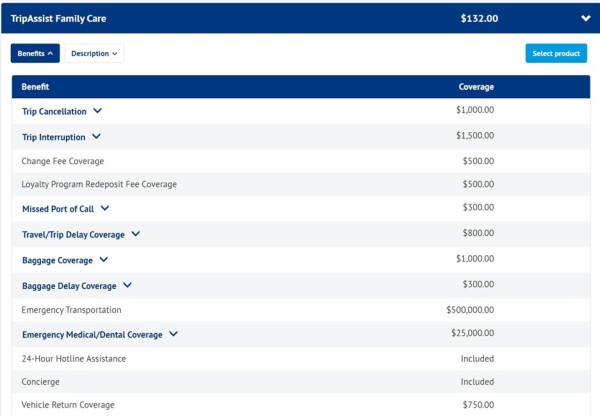

TripAssist Family Care

The TripAssist Family Care Plan increases the coverage for medical coverage to $25k and medical evacuation coverage to $500k. This plan also includes smart benefits that can pay you proactively for covered travel delays and does not require receipts for a missed port of call or baggage delay claims. Plus, kids 17 and under are covered for free when traveling with a parent or grandparent. While the medical evacuation coverage is great at $500k, the medical coverage is still low at $25k for an overseas trip, but adequate for travel in the US.

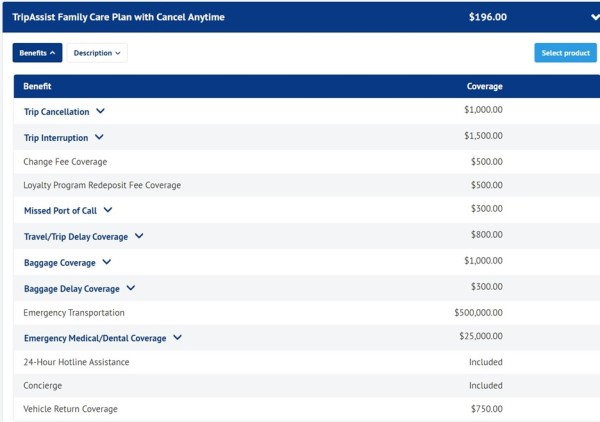

TripAssist Family Care with Cancel Anytime

The TripAssist Family Care Plan with Cancel Anytime policy adds the Cancel Anytime option to the TripAssist Family Care Plan. You can cancel for any reason that the TripAssist Family Care plan does not cover, such as fear of traveling due to COVID or simply deciding not to go and you will receive 80% of the non-refundable trip costs back.

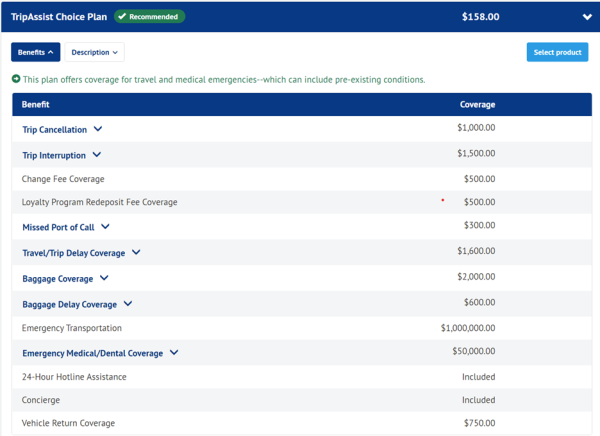

TripAssist Choice

The TripAssist Choice Plan doubles nearly all the post-departure coverage of the TripAssist Family Care Plan - including emergency medical and transportation benefits, baggage loss protection, and more. It also has benefits that can pay you proactively for covered travel delays, and not require receipts for a missed port of call or baggage delay claims. Medical coverage is $50k and medical evacuation is $1 million. The plan can also cover pre-existing medical conditions if purchased within 14 days of the initial trip payment or deposit.

This would be a good plan for travel close to home, but medical coverage is still low for travel outside the US. While it is the best plan available from AAA for travelers looking to cover a single trip, there are better options available if we shop around as we’ll see.

AAA Rental Car Protection

Rental Car Damage Protector can be purchased in conjunction with any AAA travel plan. It provides up to $40,000 of primary coverage for collision, loss, and damage, along with 24-hour emergency assistance, for $9 per day and can cover domestic and overseas auto rentals (country/area specific). The plan now includes trip interruption and baggage loss benefits of $1,000 each.

Check whether you need this type of coverage at all. Many US credit cards already have some form of secondary auto rental coverage. There are a small number that offer primary coverage.

AAA Rental Car Protection offers the following coverage:

- The rental car is damaged while you are driving.

- The rental car is damaged while it is unattended.

- The rental car is stolen.

- The rental car is damaged because of something other than a collision. Examples include fire, storm, vandalism, or theft.

- The coverage is Primary. This means that AAA Rental Car Protection will take responsibility for payments.

Note the following important pieces of small print. AAA Rental Car Protection will cover the lesser of the following, up to the amount indicated in the letter of confirmation:

- Reasonable and customary cost to repair the rental car. Including charge for loss of use of the rental car while it is being repaired.

- The actual cash value of the rental car, minus its reasonable salvage value.

Why are these two points important?

AAA Rental Car Protection has a maximum benefit of $40,000. If a customer were to rent a car worth more than $40,000, he could find himself with a significant coverage gap.

AAA Rental Car Protection – Important Exclusions

No coverage will be provided if:

- Car is rented or driven in Jamaica.

- There is a loss associated with use of alcohol or drugs.

- The rental is for 46 consecutive days or longer.

- Vehicle is a Truck, Camper, Motorbike, RV.

- Car has an original recommended retail price more than $75,000.

Our recommendation, prior to adding AAA Rental Car Protection, is to check your personal auto policy for current coverage levels outside the country and what is transferable. Check to see if any of your credit cards have coverage that is appropriate. And finally, check with the car rental company to see if your AAA membership gives increased coverage from the rental company.

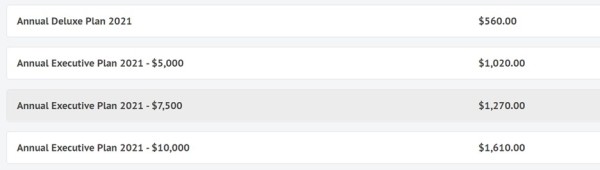

AAA Travel Insurance Annual Plans

For frequent trips throughout the year, annual plans may be a better option, but are typically more expensive than single trip plans. AAA offers two different annual travel plans, Annual Deluxe and Annual Executive. The Annual Executive plan has three levels with different amounts for trip cancellation – $5000, 7500 and $10,000, so you can choose the amount of trip coverage you prefer.

The biggest drawback with annual travel insurance plans is that the levels of coverage tend to be lower than most people need while the price is significantly higher than a single trip policy.

Also, coverage does NOT resent with each trip. Any claims processed in an annual plan will be subtracted from the overall benefit coverage. For example, if a policy has $100,000 in medical coverage and a $25,000 medical claim is paid, the annual policy now only has $75,000 remaining coverage for the rest of the benefit year.

AAA Deluxe Annual Travel Plan

The Deluxe Annual Travel Plan is the lowest priced annual plan available. This plan provides $3k of trip cancellation, $20k of medical coverage and $100k of medical evacuation coverage. Importantly, you need to contact your travel suppliers within 72 hours of cancelling or interrupting your trip to qualify for the largest reimbursement possible. If you notify your suppliers later and get a smaller refund, the Deluxe Annual plan will not cover the difference. If you’re seriously ill or injured, contact your travel suppliers as soon as you can.

Included in the AAA Deluxe Annual Travel Plan is decent coverage for those who use rental cars. It has a similar group of exclusions as the AAA Rental Car Protection plan that we discussed above.

A person who takes frequent short trips and often uses a rental car, such as a business traveler or weekend getaway traveler, may find an annual plan attractive and should be considered.

For trips within the US, the $20k in medical coverage may be sufficient, but would be too low for travel outside the US. A minimum of $100k of medical coverage is preferable for international travel. Hospitals can often charge more than $4k per day, so $20k in medical coverage can be exhausted quickly in the event of a serious injury.

The $100k in Emergency Medical Transportation is adequate for travel inside the US or destinations relatively close-by but may be inadequate for longer distances. The most expensive medical evacuation case that we have seen came in at $250k. This involved a large private jet flying from Africa back to the USA with an attending medical team. While not always a consideration to travelers, having adequate medical evacuation coverage should be considered when choosing a policy. We recommend a minimum of $150k for medical evacuation for domestic travel and $250k for overseas travel.

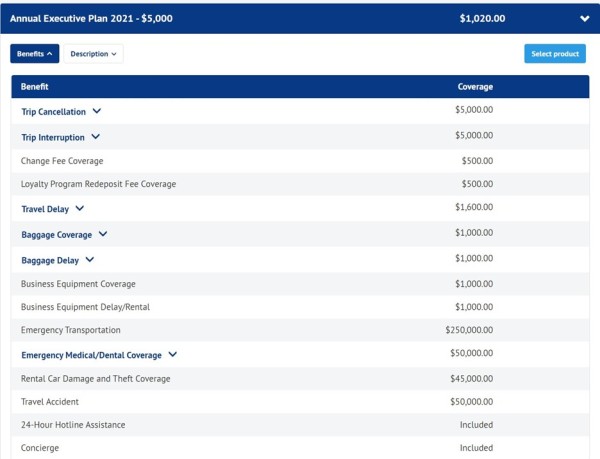

AAA Annual Executive Plan

The other annual plan offered is the Annual Executive Plan. It is designed for frequent business travelers and includes benefits to reimburse reasonable costs to rent/replace and/or repair business equipment if lost, stolen, damaged or delayed by an airline or other carriers. However, trip length is limited to 45 days or less. It will also cover (under certain conditions), quarantines and pandemic-related illnesses. The plan has three versions with varying amounts for trip cancellation and trip interruption coverages: $5000, $7500, or $10,000. Apart from the trip cancellation and trip interruption amounts, all plan benefits between the versions are identical.

The plan comes with $50k of medical coverage and $250k of medical evacuation coverage, which is more than double what the Deluxe plan offers. For frequent business travelers, the plan had decent medical coverage, though still lower than the $100k minimum we recommend for overseas travel but does have adequate medical evacuation coverage. For frequent business trips, the ability to choose one of three trip cancellation amounts is a great benefit, provided there are enough trips scheduled throughout the year to make the cost of the plan worthwhile.

Annual Executive Plan with $5k Trip Cancellation/Trip Interruption

AAA Travel Insurance Products, Rates and Comparison

Now that we’ve looked at what AAA has to offer for trip insurance, let’s see if we can find something better.

For our review, we quoted a trip for two 60-year-olds from California to Ecuador from 5/15 – 5/28 with a trip cost of $2000 and were presented with the following insurance choices:

The least expensive plan is the TripAssist Basic at $102, while the recommended plan is the TripAssist Choice at $158. In between these two we have the TripAssist Family Care at $132 and the TripAssist Family Care with Cancel Anytime at $196. Since we’re only taking a single trip, we can eliminate the annual plans.

When we quoted for the same trip at TripInsure101, our recommended option was the IMG Travel SE at $135.35.

The IMG Travel SE provides $250k of medical coverage and $500k of medical evacuation as well as trip cancellation at 100% of our trip cost and trip interruption at $150% of our trip cost. It will also provide 100% refund if we need to cancel for a work-related reason.

The AAA TripAssist Choice only provides $1000 of trip cancellation and $1500 of trip interruption along with $50k of medical coverage and $1 million of medical evacuation coverage. While the $1 million of medical evacuation coverage is nice to have, it’s a bit of overkill for us considering the medical coverage is a 1/5th of what IMG Travel SE is providing. We’d prefer higher medical coverage and even a bit LESS medical evacuation as the tradeoff. Also, with the AAA TripAssist Choice, there is no coverage if we need to cancel for a work-related reason. Pricewise, we’re paying $22.64 LESS for the IMG Travel SE as compared to the AAA TripAssist Choice and getting better trip cancellation, trip interruption, higher medical coverage and we can cancel for a work-related reason if needed.

Cancel For Any Reason (CFAR) Policies

What if we decide we want to be able to cancel for any reason? With AAA we must move up to the TripAssist Family Care Plan with Cancel Anytime for $198. This policy gives us the same $1000 for trip cancellation and $1500 for trip interruption, similar to the TripAssist Choice plan, as well as $25k for medical coverage and $500k for medical evacuation. We also have the option to cancel for any reason and receive an 80% refund of our non-refundable trip costs up to the $1000 limit of coverage.

Does TripInsure101 have something comparable?

There were several Cancel For Any Reason (CFAR) plans listed on our quote with TripInsure101. They provide either a 50% refund or 75% refund, depending on the policy.

The least expensive plan with a 75% refund that is comparable to the TripAssist Family Care Plan with Cancel Anytime is the Travel Insured Worldwide Trip Protector (CFAR 75%) for $213.12. This plan provides $100k of medical coverage, $1 million of medical evacuation, coverage for pre-existing medical conditions (if needed) if the plan is purchased within 21 days of the initial trip deposit and provides a 75% refund of our non-refundable trip costs if we cancel for a reason not listed in the policy. In addition, it also will give us a 100% refund if we need to cancel for work reasons.

The difference in pricing is slight, with the Travel Insured policy being $15.12 MORE than the TripAssist Family Care Plan with Cancel Anytime. However, the difference in coverage is much more extensive. In our example, the non-refundable trip costs were $2000. With the AAA TripAssist Family Care Plan with Cancel Anytime, if we cancel for a reason not listed in the policy (such as fear of COVID), the most we’ll get back is $800 (80% of the $1000 maximum coverage limit). With The Worldwide Trip Protector, if we cancelled for that same reason, we would receive $1500 (75% of the $2000 trip cost). For $15 more in price, we can potentially receive $700 MORE money back.

Medical coverage is 4x higher with Travel Insured ($100k in medical for Travel Insured versus $25k for TripAssist) and double for the medical evacuation coverage ($1 million for Travel Insured versus $500k for TripAssist).

Overall, we have much better coverage with Travel Insured’s plan as compared to AAA’s TripAssist Family Care with Cancel Anytime for only $15 more in price.

AAA Travel Insurance Review – Compare the Market

We think that AAA is a great organization, but AAA Travel Insurance is expensive and has weak coverage in critical areas. A simple search at TripInsure101 will allow customers to compare their options before they buy AAA Trip Insurance. We are confident that two minutes with us will get a customer much better coverage at significantly improved pricing.

Our travel insurance carriers are some of the most respected in the USA. All have at least an 'A' rating from A.M. Best, an independent research company that provides credit ratings for the insurance industry. All have excellent, highly reputable, customer service.

Incidentally, our suggestion to shop around and look for better rates with more comprehensive trip insurance protection is not an original idea. Some member organizations provide exactly this guidance to its members.

We have always advocated that it pays to shop around and that customers should be wary when buying travel insurance policies from places like Expedia or any of the airline websites.

We were surprised to find after our research, that the available AAA travel insurance was not competitive with the general market. The assumption was that members would be provided great value because of their membership. That was not what our research revealed. The pricing was expensive compared with the coverage provided. Overall, we rate AAA Travel Insurance a 6 out of 10.

The loser in all this is the AAA member. That’s why it’s essential to shop around. It takes no more than a couple of minutes to check if you are being offered good value for money from AAA. There is no cost to you to check travel insurance prices. None of your personal information is shared with any of the insurance carriers during a quote with us. Visit TripInsure101 today and see what we can save you on your next trip!

Safe travels!

This article has been written for review purposes only and does not suggest sponsorship or endorsement of AARDY by the trademark owner.

Recent AARDY Travel Insurance Customer Reviews

customer

Great for comparing options

I have used TripInsure101 twice, and am very happy with them. They make it very easy to compare the different insurance companies and options.

Valued Customer

Great site

Great site, easy to navigate, comprehensive plan offerings

Cheryl Wentz

Efficient and…

Shauna was very efficient and knowledgeable. Made the purchase easy.