Alaska Airlines Travel Insurance - 2025 Review

Alaska Airlines Travel Insurance

7

Strengths

- Available at Check-Out

Weaknesses

- No Medical and Medical Evacuation Coverages

- Insufficient Travel Insurance Coverage

Sharing is caring!

Alaska Airlines has grown steadily in recent years. It has a passionate customer base, and some unique branding. The fleet also has some of the most unique paint-jobs of any airline in the USA.

As with so many other airlines in the USA, Alaska Airlines Travel Insurance is part of the Allianz Travel Insurance family of trip insurances. What does their policy cover and should you purchase it? Let’s take a look and see what they offer and then compare it to what we can find in the open marketplace.

Our Sample Trip

For our review, we chose a roundtrip flight from Seattle, WA to Miami, FL on Oct 22 – Oct 29 for two adult travelers.

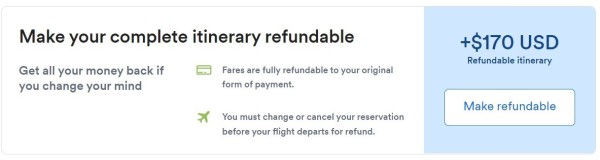

Next, Alaska Airlines offers us the choice of Refundable tickets for an additional price of $170.

Adding this upgrade allows us to get a refund of our ticket costs if we cancel prior to departure.

Next, we are presented with a few additional upgrades in case we want to be more comfortable:

A First Class upgrade would cost an additional $1531 to our cost or upgrading to Premium Class seats will add $124/traveler to each leg of the trip (for a total of $496 for both flights). Deciding that our travelers were fine with main cabin seating, we declined the upgrades and proceeded to select our seats.

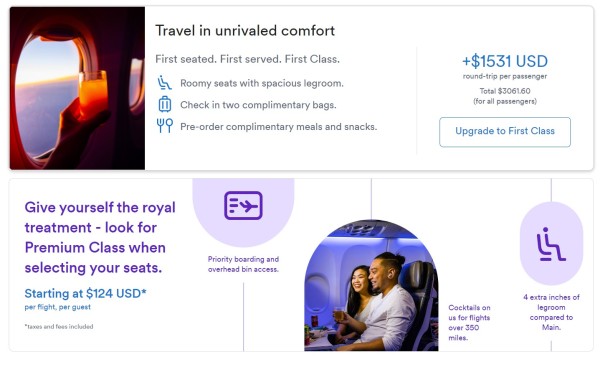

Finally, after seat selection and right before checkout, we are asked if we’d like to purchase travel insurance for the trip.

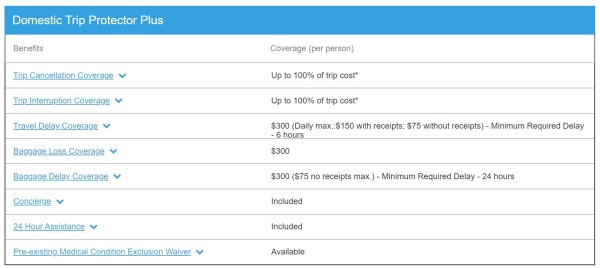

The policy is Allianz’s Domestic Travel Protector III. At first the premium for the insurance sounds quite reasonable - $50.45/traveler for a total of $100.90. But what do we get for that premium? If travelers live in any state besides CA and NY, here are the benefits:

Since our travelers live in CA, the benefits are slightly different (mainly in the Trip Delay and Baggage areas):

Slightly different again for NY travelers:

The Allianz policy covers trip cancellation and trip interruption, both up to 100% of the trip cost per traveler. Lost or damaged baggage is covered as well. Coverage can also be provided for pre-existing medical conditions, as long as the insurance is purchased within 14 days of the initial trip payment date. Exceed that purchase window and no coverage for pre-existing conditions is available and the company will look back 120 days from policy purchase to see if the traveler has a pre-existing condition that would not be covered.

However, NO medical coverage or medical evacuation coverage is provided, which is usually a main concern for travelers.

Travel insurance policies found in the marketplace will cover the same items found in the Allianz policy as well as medical coverage and medical evacuation. While most of us have medical insurance in our home state, it often doesn’t cover out-of-network or even overseas. Therefore having medical coverage in your travel policy is important when we travel.

Medical evacuation coverage gets us to a hospital that can treat us when we are severely ill or injured. This type of transportation can be extremely expensive, which is why travel insurance should cover it. Unfortunately, the Allianz policy provided by Alaska Airlines does not provide this critical benefit.

Missing these two important benefits in the Allianz policy forces us to look at other options for travel insurance in the open marketplace.

Marketplace Options For Trip Insurance

TripInsure101 is a travel insurance marketplace. We work with some of the largest trip insurance carriers in the country. We provide your travel details to them, and they provide binding quotes back which we sort in price order then highlight a plan we recommend for your trip. You don’t have to waste time shopping for quotes from individual companies.

Using TripInsure101’s quoting tool and inputting our trip details, we are presented with 25 policies to choose from. For domestic travel, TripInsure101 recommends having at least $10,000 in medical coverage and $150,000 in medical evacuation coverage. For international travel the minimums are higher - $100,000 for medical coverage and $250,00 for medical evacuation.

The least expensive plan for our trip is the Trawick Voyager at $147.72, which is the total cost for both travelers combined.

The policy provides the same 100% refund for trip cancellation as the Allianz policy but provides up to 150% refund for trip interruption versus only 100% with Allianz. More importantly, the Trawick policy provides $250,000 of medical coverage per traveler and $1 million of medical evacuation coverage per traveler – something Allianz does not provide at all. Coverage is available for pre-existing medical conditions as long as we purchase the policy on or before our final trip payment.

Trip costs with travel insurance in the marketplace can not only include the airline tickets, but any other non-refundable trip costs such as hotels, tours or excursions or transportation tickets.

For $46.82 more than the Allianz policy, we’re getting more benefits and can cover our complete trip and not just the air portion!

Cancel for Any Reason Policies

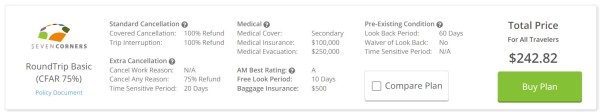

If we want flexible cancellation options, we have other choices as well when shopping in the marketplace. Cancel For Any Reason (CFAR) policies allow cancellation for any reason whatsoever and still receive either a 50% or 75% refund of the trip costs (depending on the policy purchased).

Looking at our quote from TripInsure101, the least expensive CFAR policy with the highest refund if we cancel for any reason not listed in the policy, is the Seven Corners Round Trip Basic (CFAR 75%) at $242.82 total cost for both travelers together. This policy provides $100,000 of medical coverage, $250,000 of medical evacuation coverage and gives a 75% refund of trip costs if we cancel for a reason not listed in the policy.

If you cancel for a serious illness or injury, then you would receive a 100% refund. But if there is no reason for you to ordinarily be able to claim, then the Cancel for Any Reason benefit provides 75% back.

We named this the Airline Ticket Hack, and it is a great option instead of paying additional for a refundable airline ticket.

Conclusion

After looking at what Alaska Airlines provides for insurance and comparing it to policies found on the open marketplace through sites like TripInsure101, it makes sense to shop for travel insurance instead of simply taking the policy offered during checkout with Alaska Airlines. Coverage tends to be more robust, covering more than just the ticket cost and the pricing is basically the same or less.

Does TripInsure101 Charge More?

In the USA insurance is regulated in such a way that the same policy cannot be sold at a lower price. We cover this in our article: Travel Insurance Comparison.

What does this mean to a consumer? It means that the cost of flight insurance that you see through us is the exact same as if you went direct to the insurer. We do not charge a cent more than if you went direct. You cannot get better rates. Give us one minute of your time and let us compare the travel insurance market for you to find the policy that best fits your needs.

So, enjoy your next trip with Alaska Airlines. But before you fly, check your travel insurance options.

Safe travels.

This article has been written for review purposes only and does not suggest sponsorship or endorsement of AARDY by the trademark owner.

Recent AARDY Travel Insurance Customer Reviews

June

Quick, easy, pleasant process

Destiny helped us understand the things we were unsure of and to purchase the plan that was best suited for our needs. And it was a quick, easy process.

Wendy

Time saving and good prices

Quick response and helpful information by Amanda. Saved research time and good prices.