Aurora Expeditions Travel Insurance - 2025 Review

Aurora Expeditions Travel Insurance - Review

10

Strengths

- Travel Insurance Not Offered To US Customers Leaving You Free To Find The Best Plan Online

Weaknesses

- Travel Insurance Not Offered To US Customers Leaving You Free To Find The Best Plan Online

Sharing is caring!

Aurora Expeditions is an Australian cruise line founded by Greg and Margaret Mortimer. Greg and Margaret have a passion for adventure, travel with Greg being a world-renowned explorer and mountain climber. Their cruises visit remote and exotic places such as the Antarctica, the Arctic, Iceland, Patagonia, Greenland, Panama, Costa Rica, Nepal, and many more. Aurora Expeditions offer their guests a wide range of wonderfully exciting activities whilst crusing, such as snorkeling, sea kayaking, scuba diving, and wildlife watching.

Aurora Expeditions do not sell their own branded travel insurance plan, which is considered to be great news. It leaves their customer free to find the perfect travel plan for their needs. Althoguth Aurora Expeditions doesn't sell travel insurance, they do require all travelers who cruise with them to have travel insurance, especially one which contains Medical Evacuation, with a minimum limit of $250,000. Prior to embarkation, all travelers are required to provide details of their travel insurance plan.

11.2 Passengers travelling with Aurora Expeditions are required to be covered by a reputable travel insurance policy that includes baggage loss, cancellation & curtailment of holiday, medical, accident and repatriation/emergency evacuation coverage worth at least $250,000 USD and otherwise on terms that is sufficient to indemnify you. We travel to remote regions of the world and we recommend that the insurance policy’s repatriation/emergency evacuation benefit be higher than minimum and cover you for remote or Polar Evacuation should it be required. In the case of a medical issue arising during the expedition, either on board or on shore, which results in costs for medical treatment, repatriation, evacuation, use of aircraft, etc, the responsibility for payment of these costs and expenses belongs solely to the passenger. Please ensure that such eventualities are covered by your travel insurance policy.

Given that Aurora Expeditions don't sell cruise travel insurance, our normal process of reviewing the cruise line's own branded travel protection plan and highlighting strenghts and weaknesses against other plans available is not an option to us. Instead we have decided to look at a few policies offered through TripInsure101 that would be sufficient for an Aurora Expeditions cruise.

Our Iceland Cruise

For our sample cruise we ran a quote for a cruise that will start and end in the beautiful city of Reykjavik, in Iceland. Our cruises has multiple stops around the country and heads off on August 1st, 2022, until August 11th, 2022.

For our sample cruise we have 2 travelers who are 55 and 60 years of age staying in a cabin and balcony stateroom aboard the Greg Mortimer ship. The 11-day expedition cruise costs $17,091 for both travelers.

Our Travel Insurance Options

Now, we’ll compare travel insurance policies available on through TripInsure101.

At TripInsure101 we recommend that travelers should carry at least $100,000 of Medical Insurance, $250,000 of Medical Evacuation, and we strongly suggest our travelers seek out a plan which contains a Pre-Existing Medical Condition Waiver for all trips that are outside of the US. However, given that Aurora Expeditions frequently travel to remote areas, we recommend $500,000 Medical Evacuation for those destinations.

When we ran a quote at TripInsure101, the cheapest plan that has the minimum recommended coverage is the IMG Travel SE, costing $1,111.26 for both of our travelers.

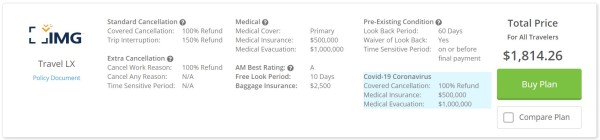

The next plan we considered for our travelers is the IMG Travel LX which costs $1,814.26 for both of our travelers. We consider the IMG Travel LX to be a fantastic option for travelers who are looking for high-end travel insurance protection with a higher-than-average coverage limit across a wide range of covered cancellation events.

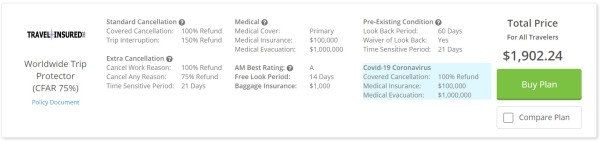

Finally in our review, the cheapest plan that would allow our travelers to Cancel For Any Reason is the Travel Insured Worldwide Trip Protector (CFAR 75%). This travel protection plan costs $1,902.24 for both of our travelers.

Having considered the three plans that we feel best potentially suit our travelers needs, we’ll now look at all three plans with a side-by-side comparison, to give further insight as to some of the most important coverage items included within these policies.

|

Benefit |

IMG Travel SE |

IMG Travel LX |

Travel Insured Worldwide Trip Protector (CFAR 75%) |

|

Trip Cancellation |

100% of trip cost |

100% of trip cost |

100% of trip cost |

|

Trip Interruption |

150% of trip cost |

150% of trip cost |

150% of trip cost |

|

Medical Insurance |

$250,000 |

$500,000 |

$100,000 |

|

Medical Evacuation |

$500,000 |

$1,000,000 |

$1,000,000 |

|

Baggage Loss/Damage |

$250/article up to $1,500 per traveler |

$250/article up to $2,500 per traveler |

$500/article up to $2,000 per traveler |

|

Baggage Delay |

$250 |

$500 |

$400 |

|

Travel Delay (Incl quarantine) |

$2,000 ($125/day) per traveler |

$2,500 ($250/day) per traveler |

$1,500 ($200/day) per traveler |

|

Missed Connection |

$500 per traveler |

$500 per traveler |

$500 per traveler |

|

Cover Pre-existing Medical Conditions |

Yes, if purchased within 20 days of deposit |

Yes, if purchased on or before final scheduled payment |

Yes, if purchased within 21 days of deposit |

|

Cancel For Work Reason |

Yes |

Yes |

Yes |

|

Interrupt For Any Reason |

No |

No |

Yes |

|

Cancel For Any Reason

|

No |

No |

75% of trip cost |

|

Accidental Death & Dismemberment |

$25,000 (common carrier) |

$100,000 (common carrier) |

$10,000 (24 hour, other than air flight) |

|

Cost of Policy |

$1,111.26 (6.2% of trip cost) |

$1,814.26 (10.1% of trip cost) |

$1,902.24 (10.6% of trip cost) |

Trip Cancellation

Trip Cancellation reimburses 100% of your total trip costs if you need to cancel your trip for a covered reason, which is one of the reasons contained within your policy. These trip costs can also include airfare, accommodations, train tickets, tours, cruise fare and any excursions, so long as those costs are pre-paid and non-refundable.

Whilst every policy wording differs, as a general rule, covered reasons for trip cancellation include:

- The unforeseen illness (including contracting Covid), accidental injury, or death of an insured, traveling companion, family member, or business partner

- A traffic accident en route to the airport

- Financial default or bankruptcy of the common carrier or travel supplier

- Destination or residence rendered uninhabitable by fire, flood, or natural disaster

- Inclement weather

- Being summoned for jury duty or subpoenaed to appear in court as a witness

- An unannounced strike causing a complete cessation of services

- Mechanical breakdown or equipment failure of a common carrier

- A terrorist incident in your destination

- A documented theft of passports or visas

- Revocation of previously granted military leave

- Cancel For Work Reason (traveler required to work during the trip)

- Employer-initiated transfer of 250 miles or more

Whist travel insurance can never look to cover every reason that causes you to cancel your trip, it should at least cover these reasons shown above. The IMG Travel SE, IMG Travel LX, and Travel Insured Worldwide Trip Protector (CFAR 75%) all cover these reasons and a good many more.

By way of example, all of these three plans cover cancellation if a new Level 4 (Do Not Travel) Advisory is issued by the US State Department for your destination. As long as the new advisory occurs after the policy has been purchased and within 30 days of your departure date. Many other travel insurance plans do not provide this coverage, so these are great options for travelers in these uncertain times.

What about lockdown orders, apprehension to travel due to Covid concerns, border closures, or simply deciding that you don't want to go on your trip? Whilst each of these could very well be a good reason to need to cancel, they are not reasons that we would expect to see covered under a travel insurance plan, at least not under the general covered reasons.

However, there is still a way to get coverage for these type of events by buying a plan which has Cancel For Any Reason coverage.

Cancel For Any Reason

Cancel For Any Reason, often referred to as (CFAR), offers travelers much more flexibility as it allows you to cancel your trip for any reason that isn't listed in the policy document, and still receive a large refund, provided certain conditions are met.

As always, plans that contains a CFAR benefit will have differing wordings, but as a general rule, to be eligible for Cancel For Any Reason coverage, you must:

- Purchase a plan within 10-21 days (depending on the policy you have bought) of placing your initial payment or deposit towards your trip

- You must Insure 100% of your pre-paid and non-refundable trip costs

- Your decision to Cancel your trip must be no later than 48 hours prior to trip departure

As for the amount you will recover with a CFAR policy, well this again depends on the plan bought. Typically you should expect to be reimbursed 50%-75% (depending on the policy) of your total trip cost when you cancel your trip for any reason that is not covered under the policy. It is worth remembering of course that if you cancel for a reason that is contained in the policy wording, then you would still be reimbursed 100% of your total trip cost.

The Travel Insured Worldwide Trip Protector (CFAR 75%) is popular due to it having the Cancel For Any Reason feature and for the fact that it also includes a benefit for Interruption For Any Reason, which we will discuss below.

Trip Interruption

Trip Interruption reimburses the unused portion of your trip if your trip is interrupted for a reason covered in your policy. The covered reasons for Trip Interruption are the same covered reasons as with Trip Cancellation. Trip Interruption can also help with the additional cost for you to catch up to your trip if possible, or the additonal cost of returning home early.

If for instance you have the misfortune to get injured during the start of your trip and won't be able to finish it, Trip Interruption will refund you for the pre-paid non-refundable part of the trip that you will miss, but it also reimburse you for the added cost of coming home early.

Interruption For Any Reason

Fortunately, all complrehensive travel protection plans provide Trip Interruption insurance, so if you must cut your trip short or experience delays, you have peace of mind knowing you are covered. But if you need to cut your trip short for a reason that isn't listed, can you get protection?

In that case, the Travel Insured Worldwide Trip Protector (CFAR 75%) permits Interruption For Any Reason. You can end your trip 72 hours or more after your scheduled departure for any reason not listed as a covered interruption on the policy.

For example, if during your trip, your cat sitter emails you stating your beloved feline has got loose and can't be found. You may want to return home and look for your cat, as you wouldn’t be able to enjoy the rest of your trip knowing that they’re not safe at home.

If this happens, Interruption For Any Reason reimburses up to 75% of your unused trip cost. That’s much better than losing the remainder of the unused portion of your trip.

Medical Insurance

Whilst Private health insurance will cover you for medical emergencies that occur within the US, health insurance typically provides very little or more often no coverage when you venrture outside of the US. A medical emergency that occurs overseas can incur significant medical bills.

Senior travelers understandably worry about medical treatment while outside the US. It is very important to understand that Medicare does not pay for non-US providers. Additionally, where as Medicare supplement plans do provide some coverage, the coverage is limited Medical Insurance to a $50k lifetime limit in an emergency and require the insured to pay 20% of the bill.

Many countries around the world provide universal healthcare to their citizens, and some citizens of other countries where there exists a reciprocalarragements, such as the European EHIC card, whereby European travelers can get free medical assistance in other European countries. Sadly there is no such arranegment for US travelers. Travelers from the US will be required to pay full price for treatment at a private hospital. Therefore, we suggest you travel with enough Medical Insurance in case something happens.

TripInsure101 recommends traveling with a minimum of $100,000 in Medical Insurance when heading outside the US. If you travel with lower limits, you risk paying out of pocket for medical bills.

Of course, both IMG plans exceed the minimum recommended amount. The Travel SE has $250,000 Medical Insurance and the Travel LX has $500,000 Medical Insurance, while the Travel Insured Worldwide Trip Protector (CFAR 75%) satisfies our minimum recommended amount.

Emergency Medical Evacuation

If you have an injury or become ill while traveling, Medical Evacuation transports you to the nearest medical facility that can treat your condition. If the physician treating you determines it to be medically necessary, Medical Evacuation then transports you home for further treatment.

Emergency Medical Evacuation may be a simple affair and it could be nothing more than a commercial flight home. However, in the case of a traumatic injury the stakes are much higher, as are the likely costs to getting you home. Consider if you were unlucky enought to suffer from a critical illness, like a heart attack or stroke, in this scenario the doctor may well order a private medical jet with medical physician and trauma nurse to fly you home.

Medical Evacuation on a private medical jet costs between $15,000 to $25,000 per hour. If your travel protection plan doesn't contain a sufficient level of evacuation cover, you could find yourself with a huge bill when you return home. That is why TripInsure101 urges travelers to protect themselves with at least $250,000 Medical Evacuation coverage. However, if you travel to a remote part of the world where medical treatment is far away, it’s wise to buy at least $500,000 Medical Evacuation insurance.

All three of the plans we have reviewed for this article would give you sufficient coverage for an Aurora Expeditions cruise, as the Medical Evacuation limit under each policy is at least $500,000.

Pre-Existing Medical Conditions

Sometimes a medical emergency may arise unexpectedly and spoil travel plans. Due to the fact that travel insurance excludes coverage for Pre-Existing Medical Conditions, we recommend senior travelers purchase a travel protection policy that has a Waiver of Pre-Existing Conditions.

Without a Waiver of Pre-Existing Medical Conditions, the insurer would look at your medical history for a period of bwteen 60-180 days (depending on the policy) prior to your purchase of the policy if you were to file a claim for a medical reason. If it transpires that a condition appears in your medical history which is within that timeframe for treatment, testing, new prescriptions, changes in medication, or a recommendation for a test or treatment not yet completed, then the policy excludes coverage for the condition.

It goes without saying of coursse that if your medical condition is older than 60-180 days, like high blood pressure, and you haven’t seen the doctor, had a change in prescriptions or worsening of condition during that time, the policy covers it.

The best solution however is a Pre-Existing Medical Condition Waiver. As the name suggests this provides a waiver to the normal pre-existing conditions within the policy. If you purchase a policy within the Time Sensitive Period (which is typically between 14-21 days after placing your initial payment or deposit toward the trip, depending on the policy) then your policy contains the waiver and covers any Pre-Existing Medical Conditions.

Please Note: not all travel insurance policies offer a waiver. If you need a waiver for a pre-existing condition, our team will be happy to show you what options are available.

The IMG Travel SE offers a waiver if the policy is purchased within the 20-day Time Sensitive Period, while the Travel Insured Worldwide Trip Protector (CFAR 75%) offers the waiver within the 21-day Time Sensitive Period.

If you have already made a payment towards your trip that is more than the time sensitive period, there is still hope. The IMG Travel LX is rather unique in that the policy will offer a waiver if the policy is purchased on the day of or before making your final scheduled payment towards the trip. This is a great option for travelers who are outside the standard 14–21-day timeframe but have not yet paid for their trip in full.

Conclusion

If you are planning your trip with Aurora Expeditions, you’ll need to compare third party travel insurance plans as Aurora don't sell their own pre-packed insurance plan. So, in order to get the best value for your money, comparing what options are available to you in the wider travel insurance marketplace is essential.

When shopping around, be sure to look for policies that include at least $100,000 Medical Insurance, $250,000 Emergency Medical Evacuation (or $500,000 if traveling to a remote destination), and whenever possible, a Pre-Existing Medical Exclusion Waiver.

Can I Find a Better Deal with the Insurer Directly?

No. Many people don’t realize that they won’t find the same trip insurance plans available at a better price. Prices are the same everywhere because of US anti-discriminatory laws. This means that no-one can sell a travel insurance plan for a cent more or a cent less that those filed prices.

When travelers want the best insurance, they shop on comparison websites like TripInsure101. We provide quotes from multiple travel insurers, so you can pick the most appropriate coverage, and have the peace of mind that you have proper protection.

In short, a travel insurance quote from TripInsure101 is the same price you see from the insurance carrier directly. We do not compete on price for insurance products -- no one does. You can count on getting the best value from us.

Have questions? We would love to hear from you. Send us a chat, email, or call us at +1(650) 397-6592.

Safe travels!

This article has been written for review purposes only and does not suggest sponsorship or endorsement of AARDY by the trademark owner.

Recent AARDY Travel Insurance Customer Reviews

customer

Comparison Table

Comparison Table; Click to read policy details

Laurel F

Destiny was very knowledgable and very…

Destiny was very knowledgable and very pleasant.

June

Quick, easy, pleasant process

Destiny helped us understand the things we were unsure of and to purchase the plan that was best suited for our needs. And it was a quick, easy process.