Princess Cruise Travel Insurance - 2025 Review

Princess Cruise Travel Insurance

6

Strengths

- Available at Check-Out

- Strong Insurance Partner

- Good Cancellation Benefits

Weaknesses

- Very Poor Medical Protection

- Weak Emergency Evacuation Cover

- Expensive

Sharing is caring!

Background

Offering cruise vacations to 380 destinations on 7 continents, Princess Cruises is one of the most well-known cruise companies in the world. Whether you are looking to drink-in the atmosphere of their award winning itineraries, sample exquisite regional daily fresh cuisine or simply looking to relax and sample the daily cocktail over a game of deck quoits, Princess has it all.

Princess Cruises offers their own branded travel insurance plan which they call Princess Vacation Protection. The Princess Vacation Protection plan is underwritten by Nationwide and administered by Aon. Both are well-known names in the insurance industry.

To review the strenghts and weakness of the Princess Vacation Protection plan, we need to go on a Princess Cruise. So sit back, relax and enjoy as TripInsure101 goes crusing with Princess.

Cruise Itinerary

For our cruise with Princess, we haven chosen a 10-day cruise for two travelers who are aged 55 and 60. Our cruise heads off from San Francisco in California and sails to the coast of Alaska leaving on April 30 to May 10, 2022. The price for our cruise is $1,798 per person which includes taxes and fees, giving a total cost of $4,246. Our cruise takes in several ports in Alaska and in Victoria, Canada. Note that we have not included the cost of airfare in our total trip cost as the pricing can vary greatly, so for this review we will use the cruise cost only.

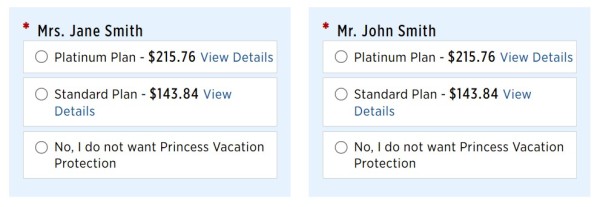

When we get to the checkout for our cruise, we’re asked if we’d like to include the Princess Vacation Protection Plan to our trip. As mentioned, this is Princess Cruises’ own insurance.

The Princess Vacation Protection Plancomes in both ‘Standard’ and ‘Platinum’. Let’s see the differences between the two.

Princess Cruise Vacation Protection Insurance – Standard Protection Levels

- Cancellation – up to 100% of trip cost if you cancel for illness, injury, death, etc.

- Cancel Any Reason – 75% of cruise cost given in future cruise credits

- Accident or Illness Medical Expense - $10,000

- Emergency Evacuation and Repatriation of Remains - $50,000

- Pre-Existing Medical Condition Waiver: No

- Trip Interruption 150% of trip cost

- Baggage Delay - $500 per Trip

- Baggage/Personal Effects - $1,500 per Trip

- Trip Delay (en route to the Trip) - $500 per Trip*

- Trip Delay (returning from the Trip) - $1,500 per Trip*

*Not to exceed $1,500 in the event of both pre- and post-cruise vacation trip delays.

Princess Cruise Vacation Protection Insurance – Platinum Protection Levels

Listing of Benefits - Maximum Benefit

- Cancellation – up to 100% of trip cost if you cancel for illness, injury, death, etc.

- Cancel Any Reason – 75% of cruise cost given in future cruise credits

- Accident or Illness Medical Expense - $20,000

- Emergency Evacuation and Repatriation of Remains - $75,000

- Pre-Existing Medical Condition Waiver: No

- Trip Interruption 150% of trip cost

- Baggage Delay - $500 per Trip

- Baggage/Personal Effects - $3,000 per Trip

- Trip Delay (en route to the Trip) - $500 per Trip*

- Trip Delay (returning from the Trip) - $1,500 per Trip*

*Not to exceed $1,500 in the event of both pre- and post-cruise vacation trip delays.

Let’s take a look at the pricing difference between the two plans:

The cost of the Platinum Plan is $71.92 more than the Standard Plan and it doubles the medical sickness coverage to $20,000 total whilst also increasing the medical emergency evacuation coverage by $15,000 to $75,000 total.

The Accident Medical Expense and Emergency Evacuation coverage levels that Princess offer in its Platinum policy are marginally better than that offered in the Standard plan, we feel this coverage level is far too low. With one of our TripInsure101 team having personally witnessed the helicopter evacuation of a cruise passenger during a dark and very stormy evening in 2019, the only thing that could possibly add to the trauma of the event itself is the massive cost if you are under-insured. $20,000 for medical expenses and $75,000 for evacuation would not be enough. TripInsure101 recommends a minimum of $100,000 for medical insurance and $250,000 for medical evacuation.

What Medical Insurance Benefits do I Need when Cruising?

Travel insurance is designed to cover the financial costs of an unforeseen event. Whether this is simply the frustration of lost luggage or a missed connection or other events that can be financially devastating, such as a medical emergency abroad or a medical evacuation back home.

For cruise travel insurance to be fit for purpose, the benefits of the travel protection plan you buy must cover the likely worst-case scenario. At TripInsure101 we will never recommend that a traveler have any less than $100,000 of Travel Medical Insurance protection. Whils this may seem like a lot of coverage, if the worst were to happen, this really is the minimum viable amount of coverage that we recommend. The question then is why do we recommend such a high level of coverage for our cruise customers? The simple reason is that a traumatic injury or illness can result in significant medical exposure if you are under-insured.

Consider if you will the cost of International private hospitals who often charge up to $3,000-$4,000 per day. The only time that we would consider less protection than this is if a traveler has an alternative medical insurance that will cover them when overseas. This option is rare.

Whilst many countries you may visit have universal healthcare for their citizens, as a tourist, you will not be entitled to use any state medical facilities that may exist. This means that if you have cause to use the medical facilities in a host country, you will be requried to pay full cost to use those local private health facilities. Additionally, the US State Department will not provide you with financial support to pay for overseas health care – your medical bill is solely your responsibility.

What Medical Evacuation Benefits Do I Need When Cruising?

Medical Evacuation is when you have an incident or illness and it is so serious that you need to be transported home or to a medical facility. This may simply mean getting on the next commercial flight, or it may require a private jet with medical staff onboard, or even a helicopter evacuation.

The costs of these emergency medical evacuation trips can be extraordinary. It is our recommendation that for those who are traveling within 3 to 4 hours of the USA should have $250,000 of Medical Evacuation coverage when they buy their cruise travel insurance. If you are venturing further afield, we recommend that $500,000 of medical emergency evacuation cover should be sufficient.

Comparison Quotes

Based on our sample couple who are aged 55 and 60, we created a comparison quote using TripInsure101’s travel insurance marketplace engine. The trip cost that we used for the comparison is the cruise cost for both of our travelers which is $1,798 per person plus taxes and fees of $650, giving us a total of $4,246.

As we mentioned above, when traveling outside the United States, we recommend a minimum coverage of $100k in Medical Insurance, $250k in Medical Evacuation (and more if traveling further afield from the US), and we strongly advise you seek out a Pre-existing Medical Condition Waiver in whichever policy you buy. We used these criteria to choose the selected quotes.

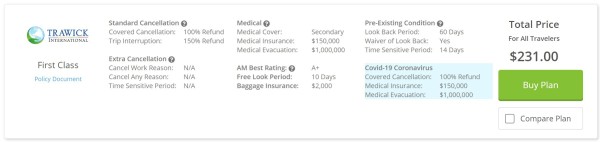

The least expensive plan which provides an adequate coverage level on our quote from TripInsure101 is the Trawick First Class. This plan would be comparable to the Princess Cruise Vacation Protection Standard Plan.

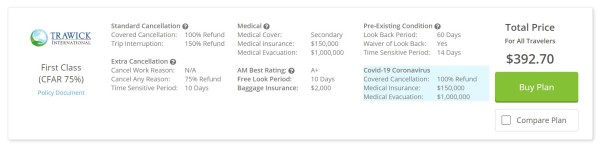

If you wished for the added protection afforded by a policy which contains a Cancel For Any Reason coverage, we would chose the Trawick First Class (CFAR75%), because it is the least expensive plan with Cancel For Any Reason (CFAR) benefits and would be comparable to the Princess Cruise Vacation Protection Platinum Plan.

Next, so that we can easily compare and contrast the available options, we broke down the benefits of each policy in a side-by-side comparison.

|

Benefit |

Princess Standard Trip Protection |

Princess Platinum Trip Protection |

Trawick First Class |

Trawick First Class (CFAR 75%) |

|

Trip Cancellation |

100% of trip cost for illness, injury or death

75% of trip cost in cruise credit for reasons not listed in policy |

100% of trip cost for illness, injury or death

75% of trip cost in cruise credit for reasons not listed in policy

|

100% of trip cost |

100% of trip cost |

|

Trip Interruption |

Up to 150% of trip cost |

Up to 150% of trip cost |

150% of trip cost |

150% of trip cost |

|

Medical Insurance |

$10,000 |

$20,000 |

$150,000 |

$150,000 |

|

Medical Evacuation |

$50,000 |

$75,000 |

$1,000,000 |

$1,000,000 |

|

Baggage Loss/Damage |

$3,000 |

$3,000 |

$500/article up to $2,000 per person |

$500/article up to $2,000 per person |

|

Baggage Delay |

$500 |

$500 |

$400 |

$400 |

|

Travel Delay (Incl quarantine) |

$1500 |

$1500 |

$1000 per person |

$1000 per person |

|

Missed Connection |

No |

No |

$1000 per person |

$1000 per person |

|

Covers Pre-existing Medical Conditions |

No |

No |

Yes if purchased within 14 days of deposit |

Yes if purchased within14 days of deposit |

|

Cancel For Work Reason |

No |

No |

No |

No |

|

Interrupt For Any Reason |

No |

No |

No |

No |

|

Cancel For Any Reason

|

75% of cruise cost (cruise credit only) |

100% of cruise cost (cruise credit only) |

No |

75% of trip cost if purchased within 10 days of deposit |

|

Accidental Death & Dismemberment |

None |

None |

$25,000 |

$25,000 |

|

Cost of Policy |

$287.68 (6.77% of trip cost) |

$431.52 (10.16% of trip cost) |

$231.00 (5.44% of trip cost) |

$392.70 (9.25% of trip cost) |

Cost Comparison

To compare to Princess’ Standard Plan, our recommended plan is the Trawick Frist Class at $231.00. This plan provides $150,000 of medical coverage and $1 million of medical evacuation coverage and costs $56.68 LESS than Princess Cruises’ Standard Plan. The cover is also about FIVE TIMES more than Princess will provide!

To compare to Princess’ Platinum Plan, our recommended plan is the Trawick Frist Class (CFAR 75%), at $392.70. This plan provides is identical to the Trawick First Class but it also adds the Cancel For Any Reason (CFAR) option discussed above. This plan also provides $150,000 of medical coverage and $1 million of medical evacuation cover and is $38.82 LESS than Princess Cruises’ Platinum Plan. Again the coverage is also about FIVE TIMES greater than what Princess will provide!

In our opinion, the Princess Cruises Standard Protection Plan and Protection Plan Plus have low coverage for travelers venturing away from home. The Platinum Plan does increase coverage over and above the Standard Plan, but not by much.

By shopping for cruise insurance through TripInsure101, our two travelers can save between $37.82 to $56.58 which can be applied to other things like shopping, and get far superior travel insurance protection.

In the following sections of this review, we will discuss the main areas you should expect to see when shopping for travel insurance for your Princess cruise.

Trip Cancellation

Many travelers are concerned by the need to cover their trip against an unforseen event that causes you to have to cancel your trip. Trip Cancellation protects your vacation investment if you are taken ill or had an accidental injury prior to your departure date. If you were unfortunate to experience such an event, you may have to cancel your travel arrangements which may result in financial loss. While disappointing to have to cancel your trip, Trip Cancellation is even more painful without cancellation insurance.

The Princess Cruise Vacation Protection Plan do both provide for cancellation for the following reasons to receive a cash refund of the full trip cost:

- Unexpected injury, illness, or death of traveler or immediate family member

- Involvement in a traffic accident en route to your departure causing you to miss the cruise

- Called to jury duty or subpoena

- Residence made uninhabitable by natural disaster, fire, flood, hurricane etc.

- Called to active military duty to respond to a national disaster

If you need to cancel your trip for a reason that is not wihtin this limited list, Princess will provide a cruise credit of 75% of the total trip cost that is only good for one year. If for whatever reason you cannot use the cruise credit during that period, the cruise cost is lost. Also, Princess Vacation Protection Plans do NOT cover any travel arrangement which are made outside of Princess Cruises, such as your flights to your port.

Both the Trawick First Class policy and the Trawick First Class (CFAR75%) policy can cover ALL costs which are prepaid and non-refundable. In addition, both plans offer a 100% refund for Trip Cancellations for covered events, a 150% refund for Trip Interruptions for covered events, and a substantial list of covered reasons, including needing to cancel your trip due to having caught COVID. The Trawick First Class (CFAR 75%) will also pay a 75% refund in cash if you need to cancel your trip for any other reason that is not listed in the policy. This is a cash refund and not cruise credit like the Princess plans. At TripInsure101 we believe cash is always a better option than cruise credits which may or may not be used.

Trip Interruption

A Trip Interruption is a situation which occurs during your trip that causes you to need to miss some or the rest of your vacation. Trip Interruption cover is like Trip Cancellation but for eventw that occur during your trip.

The most common trip interruption would be an injury or illness sustained on your vacation but where you can continue traveling after treatment. Trip interruption will reimburse you for the unused portion of your trip, and also the cost to rejoin your trip in progress. This may be connecting flights to your next port to rejoin your ship.

Trip interruption also includes events that could occur to a family member who may have a sudden serious illness or who may have sadly passed away. If your covered situation requires that your trip is cut short and going home early, Trip Interruption reimburses you for the unused portion of the trip, plus the added cost of getting you home early.

In the Princess Vacation Protection travel insurance policy, Trip Interruption benefits include reimbursement of unused trip costs paid to Princess Cruises plus the added cost of transportation home. They will not reimburse for any travel arrangement made outside of Princess Cruises. If you therefore needed catch an earlier flight home at short notice, the additonal cost of that flight would not be covered by Princess.

Travel insurance plans like the Trawick First Class and Trawick First Class (CFAR 75%) also offer 150% of trip costs for interruption. Therefore, they cover up to 100% of the unused trip costs, plus up to an additional 50% to cover transportation costs to return home.

Cancel For Any Reason

Cancel For Any Reason cruise insurance provides the highest level of flexibility and reimbursement in the Travel Insurance world, and provides cover if you must cancel your trip for any reason not covered by the policy.

If you cancel your Princess cruise for a reason not listed in the Princess policy, they will grant future credits for 75% of the prepaid, non-refundable cancellation fees paid to them, but as mentioned above, those credit will expire after one year. Also that are non-transferrable and not redeemable for cash. Princess, not their insurance policy, provides this part of the Vacation Protection Plan. When it comes to refunds, we always prefer cash since future credits may not be used.

Alternatively, travel insurance policies like Trawick First Class with Cancel For Any Reason included pay a 75% cash refund of all prepaid, non-refundable trip costs including arrangements made outside of Princess Cruises. This could include flights, hotels, rental cars, excursions, and transfers.

Cancel For Any Reason policies have several stipulations:

- Purchase the policy within 10 - 21 days (depending on policy), of your initial payment or deposit date and

- Insure 100% of the prepaid trip costs subject to cancellation penalties or restrictions. For additional prepaid non-refundable payments made after the purchase of the policy, insure within 10-21 days (depending on policy), of each subsequent payment added to your trip, and

- Cancel your trip 2 days or more before your scheduled departure date.

Medical Insurance for Emergency Treatment

One of the most crucial factors in selecting your travel insurance plan is ensuring it has adequate Medical Insurance when you travel. Anything can happen when you are on vacation as it could when you are at home, including accidental injuries or sudden illness.

If you have a medical emergency when traveling and don’t have proper medical insurance coverage when overseas, you may find yourself with a substantial hospital bill to cover. Whereas many countries to provide universal health care for their citizens, many Americans mistakenly believe that those countries with universal health care will treat them for free. Unfortunately, this is not the case.

Instead, as an American, if you fall ill whilst abroad you will receive treatment at a private hospital, not public, and you will be required to pay privately like anyone else. Whilst costs differ from country to country, admission for inpatient care can cost around $3,000-$4,000 per day, plus the cost of whatever treatment you may need, be it x-rays, surgeries or specialist procedures and consultations.

It is also worth remebering that MediCare will not pay for hopsitalization when you are overseas. sadly this a common misconception which can be very costly if you find yourself in a hospital abroad with only your MediCare card for support. Some Medicare supplements do cover overseas, but they have a lifetime limit and reduced benefits, and they pay for emergencies only. They can still require you to pay 20% of the costs. As a result, you could go on vacation and end up with medical bills in the thousands.

TripInsure101 urges overseas travelers to take travel medical insurance of at least $100,000 per person. In a medical emergency, $100,000 provides ample health care and helps protect your retirement savings from unexpected financial burdens.

Princess Vacation Protection Plan provides a $10,000 benefit for Medical Insurance on their Standard Plan and $20,000 for the Platinum Plan, which is far below our recommended minimum of $100,000. Both Trawick’s First Class policies includes $150,000 per person of Medical Insurance, so you can receive proper treatment without ending up in debt.

Emergency Medical Evacuation

Medical Insurance isn’t the only potentially expensive part of a trip. Emergency Medical Evacuation transports you from the place of injury or illness to the closest hospital. Once you’re stable enough for transport, Medical Evacuation brings you home via commercial flight or, if necessary, private medical jet with onboard Doctors and nurses to support you on the trip.

Medical flights can cost up to $25,000 per hour and regular health insurance will not cover it. In addition, it is worth remebering that the US State Department will not offer any medical treatment or evacuation assistance for US citizens. TripInsure101 advises travelers to get at least $250,000 Medical Evacuation to assure there’s enough coverage to get them back home from almost anywhere if they experience a serious medical event.

Princess’ Vacation Protection Plan includes Medical Evacuation up to $50,000 per person on the Standard Plan and increases to $75,000 on the Platinum Plan. The Trawick First Class policies provide $1,000,000 per person for Medical Evacuation, so you can feel secure knowing you have adequate coverage to transport you back home if needed.

Pre-existing Medical Conditions

A significant concern for senior travelers can be pre-existing medical conditions. A Pre-Existing Medical Condition is one in which you’ve received medical treatment, testing, medication changes, added new medications, or received a recommendation for a treatment or test that hasn’t happened yet. Most travel insurance policies exclude pre-existing conditions unless you purchase the policy within the required time period from your initial trip deposit date (called the Time Sensitive Period). Otherwise, the insurer will look backward 60, 90, or 180 days (depending on the policy) from the date you purchased the insurance to see if there are any pre-existing medical conditions they won’t cover. This is called the Look Back Period. Any medical conditions older than this Look Back Period, unchanged or stabilized with no medication dosage changes are covered, as are any new conditions that arise after you purchase the policy.

If you must cancel, interrupt, or seek medical treatment for a medical condition while traveling, travel insurance policies typically exclude claims related to Pre-existing Medical Conditions. However, if you purchase the policy within a few days of your Initial Trip Payment or Deposit date, many policies add a Waiver to the policy that covers Pre-existing Conditions. As a result, there is no Look Back Period and Pre-existing Conditions are covered.

The Princess Vacation Protection Plan covers NOT cover Pre-Existing Medical Conditions. However, the Trawick First Class policies will cover Pre-existing Medical Conditions provided you purchase the policy within 14-days of your initial trip deposit or payment.

Price and Value

In our opinion, the Princess Vacation Protection Standard Plan and Platinum Plan carry minimal coverage levels which are unlikely to be sufficient if you find yourself in need of them, and are also more expensive than other available travel insurance options. The medical insurance coverage is at most $20,000, and $75,000 for medical evacuation when choosing the Platinum Plan, which may not be adequate for a serious illness or injury. Cancellation reasons are limited and the Cancel For Any Reason coverage only grants future cruise credits that expire after a year. Overall, the Princess Vacation Protection Plan offers limited value for the price.

In contrast, by comparison shopping, we found the Trawick First Class policy comes in at $231.00, ($56.68 LESS than Princess). It includes superior medical and evacuation benefits, 100% refund for trip costs, including those made outside of Princess Cruises, for covered cancellation, a 150% refund for a covered trip interruption, and a robust list of cancellation reasons.

Choosing the Vacation Protection Platinum Plan from Princess didn’t provide much better value. It carries the same benefits as their Standard Vacation Protection Plan and similarly, the Cancel For Any Reason option will only provide a 75% cruise credit for up to one year. Again, by comparison shopping, we found the Trawick First Class (CFAR 75%) for $392.70, ($38.82 LESS than Princess). It includes $150,000 medical insurance and $1,000,000 medical evacuation. Plus, it includes a Cancel For Any Reason provision that refunds 75% of trip costs back in cash, rather than future credit. It has superior coverage over Princess’ policy and costs less.

Conclusion

Princess Cruises Vacation Protection Plan insurance provides travelers with a minimal insurance policy for a high cost that could leave travelers unpleasantly surprised during an emergency. Medical coverage and medical evacuation limits are low, and there are a limited number of covered cancellation and interruption reasons, as well as insufficient trip cost reimbursement. Though they have a strong reputation for excellent cruise service, their insurance is rather weak. Overall, we rate it a 6 out of 10.

Travelers planning a Princess cruise vacation will find the best value for their money and peace of mind when they shop for travel insurance at TripInsure101 Travel Insurance Marketplace. There, you can review dozens of options and select the best policy to fit your needs.

To help you find the best policy, TripInsure101 recommends having at least $100,000 in travel medical coverage and $250,000 - $500,000 (depending on distance from the US) for emergency medical evacuation when traveling outside the US. And, if you purchase the policy within the 14-21 days of initial trip payment, please consider a travel insurance policy with the pre-existing condition waiver included to ensure the most coverage for your money.

If you are planning a Princess cruise in 2022, be sure to pack insurance before you travel. You never know when you may need it.

Have questions? Chat with us online, send us an email at agent@TripInsure101.com or alternatively call us at +1(650) 397-6592. We would love to hear from you.

Safe Travels!

This article has been written for review purposes only and does not suggest sponsorship or endorsement of AARDY by the trademark owner.

Recent AARDY Travel Insurance Customer Reviews

June

Quick, easy, pleasant process

Destiny helped us understand the things we were unsure of and to purchase the plan that was best suited for our needs. And it was a quick, easy process.

Wendy

Time saving and good prices

Quick response and helpful information by Amanda. Saved research time and good prices.

Terry

Excellent service

Excellent service. Pricing was very good for our trip. Will use their services again.