Quark Expeditions Travel Insurance - 2025 Review

Quark Expeditions Cruise Travel Insurance - Review

7

Strengths

- Good Medical Evacuation

- Easy to buy

- Reputable insurance partner

Weaknesses

- Weak Medical Insurance

- High cost

Sharing is caring!

Introduction

Quark Expeditions offers unique cruise adventures to the polar regions of the world: the Arctic and Antarctic. Quark Expeditions’ cofounders, Lars Wikander and Mike McDowell, the cofounders of Quark Expeditions, took the first group of commercial travelers to the North Pole In 1991. With that inaugural expedition—the first-ever tourism transit of the Northeast Passage— Quark Expeditions has become the leader in polar excursions. Polar expeditions have evolved since Quark Expeditions’ 1991 journey, but Quark continues to achieve new firsts and forge new paths in polar explorations.

Quark Expeditions Requires Travel Medical Insurance for Embarkation

Quark’s terms and conditions repeatedly and emphatically recommend passengers buy travel insurance. Interestingly, Quark requires that all travelers have “adequate medical coverage prior to embarkation” or the guest will be denied passage. Specifically, they require a minimum of $50,000 Medical Insurance.

However, Quark Expeditions does not sell its own travel insurance. Instead, they have partnered with TripMate to provide their travelers with insurance. TripMate offers two options for Quark Expeditions: The Deluxe plan and the Deluxe Plus plan. They are identical plans, but TripMate charges 50% more for the same insurance just to add Cancel For Any Reason.

Both plans include $50,000 Medical Insurance, $500,000 Medical Evacuation, and a Pre-existing Medical Condition Waiver. TripInsure101 recommends a minimum of $100,000 Medical Insurance for travelers leaving the United States, so we are surprised to see Quark require such a low amount of medical insurance for polar travel.

The trip insurance policy is underwritten by United States Fire Insurance Company, a reputable insurer familiar to TripInsure101. Many policies offered on TripInsure101 website are also underwritten by US Fire.

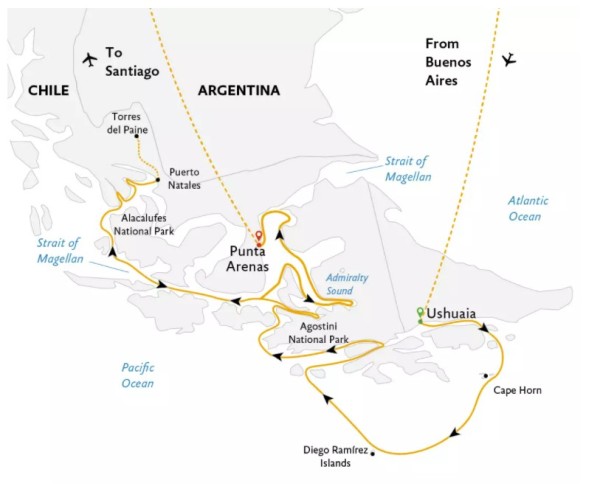

Our Cruise: Essential Patagonia: Chilean Fjords and Torres del Paine

Our sample trip is a 15-day cruise from 3/15/22 – 3/29/22 to Patagonia to see the Chilean Fjords and Torres del Paine to retrace Charles Darwin’s epic voyage.

Our travelers aged 60 and 55 will need to fly to Buenos Aires, Argentina to begin the cruise but since flight costs can greatly vary, we’ll focus on just the cruise cost in this review. We’ve chosen a balcony room which provides a wonderful view as we cruise. Total cost for the cruise including taxes and fees is $26,813.

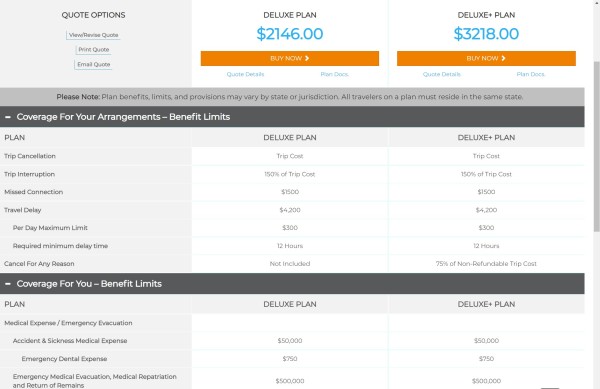

Prices for Quark Expeditions Deluxe and Deluxe Plus

For our Patagonia trip, Quark’s travel insurance plans through TripMate cost $2,146 for Deluxe or $3,218 for Deluxe Plus. As mentioned previously, both plans provide $50,000 of medical coverage and a generous $500,000 for medical evacuation.

Next, we review other options you have for travel insurance on the wider market.

Comparison Quotes

When comparing quotes, TripInsure101 recommends travelers have at least $100,000 in Medical Insurance, $250,000 in Emergency Medical Evacuation and a Waiver of Pre-existing Medical Conditions when traveling abroad. These benefits ensure you’re covered for any unforeseen medical emergency overseas.

However, since Quark travels to remote polar regions of the world, we recommend at least $500,000 Medical Evacuation since emergency medical treatment is difficult to reach.

Price and Value

Next, we received a quote from TripInsure101 Travel Insurance Marketplace to see what other options are available.

Travel insurance policies available on the wider market include all travel arrangement costs including cruise fare, airfare, hotels, rentals, excursions and tours.

The least expensive plan with at least $100,000 medical insurance and $500,000 Medical Evacuation coverage is the IMG Travel SE. It has $250,000 of medical coverage and $500,000 of medical evacuation coverage and is priced at $1,735.65, over $400 LESS than the Deluxe travel insurance.

Then, we found the least expensive Cancel For Any Reason plan which would be comparable to the Deluxe Plus plan - the John Hancock Silver (CFAR 75%), priced at $2,890.50. It has $100,000 of medical coverage and $500,000 of medical evacuation coverage and is $327.50 LESS than its counterpart, the Deluxe Plus.

Here is a side-by-side comparison of Quark Deluxe/Deluxe Plus, IMG Travel SE and John Hancock Silver (CFAR 75%):

|

Benefit |

Quark Deluxe |

Quark Deluxe Plus |

IMG Travel SE |

John Hancock Silver (CFAR 75%) |

|

Trip Cancellation |

100% of trip cost |

100% of trip cost |

100% of trip cost |

100% of trip cost |

|

Trip Interruption |

150% of trip cost |

150% of trip cost |

150% of trip cost |

150% of trip cost |

|

Medical Insurance |

$50,000 |

$50,000 |

$250,000 |

$100,000 |

|

Medical Evacuation |

$500,000 |

$500,000 |

$500,000 |

$500,000 |

|

Baggage Loss/Damage |

$1,500 |

$1,500 |

$500/article up to $2,000 per person |

$1,000 per person |

|

Baggage Delay |

$750 |

$750 |

$400 |

$500 |

|

Travel Delay (Incl quarantine) |

$4,200 ($300/day) |

$4,200 ($300/day) |

$2000 per person ($125/day) |

$1000 ($200/day) |

|

Missed Connection |

$1,500 |

$1,500 |

$500 per person |

$750 per person |

|

Cover Pre-existing Medical Conditions |

Yes, if purchased within 21 days of deposit |

Yes, if purchased within 21 days of deposit |

Yes, if purchased within 20 days of deposit |

Yes, if purchased within 14 days of deposit |

|

Cancel For Work Reason |

No |

No |

100% of trip cost |

No |

|

Interrupt For Any Reason |

No |

No |

No |

No |

|

Cancel For Any Reason

|

No |

75% of trip cost |

No |

75% of trip cost |

|

Accidental Death & Dismemberment |

$25,000 |

$25,000 |

$25,000 |

$100,000 |

|

Cost of Policy |

$2,146.00 (8% of trip cost) |

$3,218.00 (12% of trip cost) |

$1,735.65 (6.5% of trip cost) |

$2,890.50 (10.8% or trip cost) |

Trip Cancellation

Trip Cancellation pays a 100% refund of all trip costs if you must cancel your trip due to a covered reason named in the travel insurance policy.

Quark’s cruise travel insurance plan includes a healthy list of cancellation reasons:

- Unforeseen injury, illness or death of traveler, family member or business partner

- Traveler’s home or destination uninhabitable due to natural disaster

- Hijacking, quarantine, jury duty, subpoena

- Strike

- Theft of passport or visa

- Traveler’s place of employment unsuitable for business due to fire, flood, burglary, or natural disaster and required to work as a result

- Permanent transfer of employment of 250 miles or more

- Inclement weather or mechanical breakdown causing 12 hours or more delay of common carrier

- Involved in traffic accident en route to departure point

- Government-mandated shutdown of airport or air traffic control due to natural disaster

- Terrorist incident within 30 days of departure in city listed on itinerary

- Revocation of military leave due to war

- Traveler called to military duty for natural disaster (not war)

- Bankruptcy or default of airline, cruise line, tour operator

- Involuntary termination or layoff

Both IMG Travel SE and John Hancock Silver (CFAR 75%) include several additional reasons such as hurricanes, mandatory evacuation, and victim of assault. IMG Travel SE also includes a Cancel For Work Reason. If a traveler or family member is required to work and the employer rescinded previously approved time off, IMG Travel SE permits this reason for cancellation.

Cancel For Any Reason

The Quark Deluxe Plus provides an extra layer of peace of mind, allowing you to cancel your trip for ANY reason not otherwise covered by the plan documents and receive reimbursement for 75% of your unused non-refundable prepaid expenses for travel arrangements.

The John Hancock Silver (CFAR 75%) also offers the same benefit, but costs $327 less than the Deluxe Plus.

Both Deluxe Plus and Worldwide Trip Protector Plus require the following conditions for Cancel For Any Reason:

- Purchase the policy within 21 days (for the Deluxe Plus) or 14 days (for the John Hancock Silver) from the date your initial payment or deposit for your trip is received, and

- Insure 100% of your prepaid trip costs that are subject to cancellation penalties or restrictions, and

- Cancel your trip two (2) days or more before your scheduled trip departure date.

Trip Interruption

Trip Interruption insurance reimburses the unused portion of the trip if you must interrupt travel for a reason listed in the travel insurance policy. You receive up to 100% of the insured trip costs insured, plus up to 50% more for the added transportation costs.

If you had a medical emergency, but were cleared to rejoin your trip, it includes the cost of rejoining the cruise in progress. If you had to leave early for a family medical emergency, you could also receive reimbursement for transportation costs home. The amount reimbursed for travel is limited to the amount stated in the policy.

Medical Insurance

In the US, many of us are covered for emergency no matter which state we visit. However, most health insurance plans offer low or no international Medical Insurance.

Before assuming you’re covered, consider that:

- Medicare doesn’t pay outside the US

- Some supplements only cover up to $50,000 for emergency treatment

- Americans pay full price at private hospitals because universal health care doesn’t cover Americans

- Hospital stays can cost $3,000-$4,000 per night

- The US State Department does not provide medical insurance or medical evacuation

Quark Expeditions requires that every passenger has at least $50,000 Medical Insurance before embarking. Conveniently, Quark’s travel insurance plans include exactly $50,000 Medical coverage.

But TripInsure101 recommends each traveler carry at least $100,000 Medical Insurance when leaving the US. Any less than $100,000 and you risk using your retirement savings paying for hospital bills in a foreign country. Quark’s low $50,000 is a good start, but simply not enough to be reliable in a critical situation.

IMG Travel SE includes $250,000 Medical Insurance per person, while the John Hancock Silver (CFAR 75%) provides $100,000 per person, so you can receive proper treatment without ending up in debt.

Emergency Medical Evacuation

When travelers experience a critical illness or injury while overseas, Medical Evacuation transports them to the nearest hospital. Once they’re stable, Medical Evacuation provides transportation home. If the patient requires a medical team to monitor their condition during transportation, it could cost anywhere from $15,000 to $35,000 per flight hour.

Due to the high cost, TripInsure101 recommends all travelers voyaging outside the US secure at least $250,000 Emergency Medical Evacuation protection or $500,000 for remote destinations like Antarctica.

Interestingly, Quark Expeditions provides $500,000 Medical evacuation automatically with the cost of the cruise, regardless of which travel insurance you buy. They understand how remote travel can make medical treatment difficult, citing the closest medical center is 72 hours away. Quark’s travel insurance includes another $500,000 Medical Evacuation, as does IMG Travel SE and John Hancock Silver (CFAR 75%).

Pre-existing Medical Conditions

We mentioned the Pre-existing Medical Condition Waiver earlier, but what does that really mean?

Travel insurance policies exclude Pre-existing Medical Conditions by default. Many policies include a Waiver that allows the policy to cover Pre-existing Conditions if the policy is purchased within a short period of time (called the Time Sensitive Period) after making the Initial Deposit or Payment.

But what is a Pre-existing Condition? Doesn’t everyone have them?

Quark cruise travel insurance defines a Pre-existing condition as:

An illness, disease, or other condition during the 60-day period immediately prior to the date Your coverage is effective for which You or Your Traveling Companion, Business Partner or Family Member scheduled or booked to travel with You:

- Received or received a recommendation for a test, examination, or medical treatment for a condition which first manifested itself, worsened or became acute or had symptoms which would have prompted a reasonable person to seek diagnosis, care or treatment; or

- Took or received a prescription for drugs or medicine.

- Item #2 of this definition does not apply to a condition which is treated or controlled solely through the taking of prescription drugs or medicine and remains treated or controlled without any adjustment or change in the required prescription throughout the 60 day period before coverage is effective under this Plan.

Quark, IMG and John Hancock all have 60 day look back periods (the amount of time the insurance company concerns itself with your medical history before you bought your policy). Shorter look back periods are better for travelers. Some travel insurance plans look back much farther, like 90, 180, or 365 days, making it harder to get a Pre-existing Medical Condition covered.

A Pre-existing Condition Waiver can mean the difference between whether or not a trip insurance policy covers your cancellation or medical treatment. TripInsure101 recommends travelers, especially seniors, purchase a travel insurance plan that covers pre-existing conditions whenever possible.

Conclusion

Quark Excursions offers policies with low Medical Insurance, and adequate Medical Evacuation, Trip Cancellation, andTrip Interruption benefits. But their prices are higher than what you can find on the open market. Overall, we rate them a 7 out of 10.

If you are planning a polar adventure with Quark Excursions, be sure to shop around and compare your travel insurance options before committing to an overpriced, underperforming policy. While you are looking, remember to seek out policies with at least $100k in Medical Insurance coverage, $250k in Emergency Medical Evacuation ($500k for remote locations), and whenever possible, a Pre-existing Medical Condition Waiver.

Can I Save Money by Buying Directly from the Carrier?

No. You can relax knowing you get the same price at TripInsure101 as you do from the provider directly for the same policy.

We guarantee that you will not find a lower price anywhere for the same products found on TripInsure101

Whatever the case, visit TripInsure101 first to shop around so you know your options and can make an informed decision and get peace of mind.

Have questions? Stop by and have a chat, send an email or give us a call at +1(650) 397-6592.

Safe travels!

This article has been written for review purposes only and does not suggest sponsorship or endorsement of AARDY by the trademark owner.

Recent AARDY Travel Insurance Customer Reviews

Wendy

Time saving and good prices

Quick response and helpful information by Amanda. Saved research time and good prices.

Terry

Excellent service

Excellent service. Pricing was very good for our trip. Will use their services again.

customer

Melanie was very helpful and explained…

Melanie was very helpful and explained the differences in policies. She listened to my insurance needs and was able to match a policy that met them. She was very knowledgeable, courteous and professional.