SAGA Travel Insurance - 2024 Review

SAGA Travel Insurance

8

Strengths

- Strong Insurance Partner

- Designed for Seniors

- Excellent Coverage

Weaknesses

- Not Available To US Residents

Sharing is caring!

SAGA Travel Insurance is offered by SAGA, a UK company that offers products and services to consumers who are 50 years and over. It is reported to have in excess of 2.7 million customers.

As a brand, SAGA is generally very well regarded and strives to offer goods and services which are tailored to its over-50 members.

SAGA Travel Insurance – Website

The SAGA website is well presented with good colors and font size which are clearly legible. The tabs across the home page let the user navigate around the site with ease.

Saga Travel Insurance is just one of the products offered. SAGA also has Saga Car Insurance, Saga Home Insurance as well as additional tabs on its home page for Holidays, Money, Care, Health and Magazine.

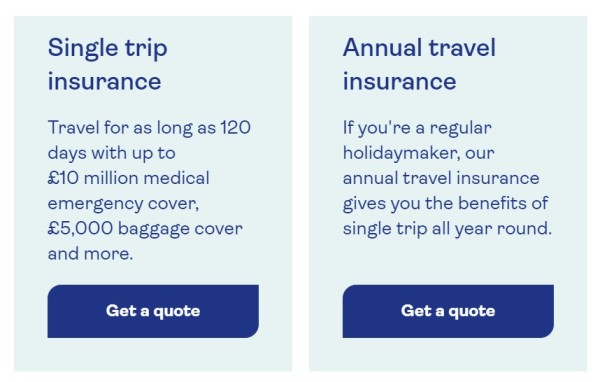

The tab to direct customers to Saga Travel Insurance is clear and obvious and sends the customer to a page where they can choose either buy SAGA Travel Insurance Single Trip or a SAGA Travel Insurance Annual Multi-Trip.

SAGA also makes it easy to navigate directly to the policy documentation with just a few clicks on the ‘Single Trip’ on the left column, and following the prompts offered to download the policy document.

Having selected single trip, the quote screen has really simple functionality to progress the quote and the steps to complete your purchase and the progress you are making are shown clearly at the top of the page.

For trip destination, we see a feature we really like. The customer merely starts typing their destination into the search parameter, and the website auto completes their destination, becoming more accurate as they continue to type. It also offers the user the ability to add additional countries to their trip.

The departure date is a calendar drop down box, and once selected, you are immediately offered a click button for some of the most likely vacation durations, including seven nights, ten nights and 14 nights. The final option allows you to select your own dates of travel.

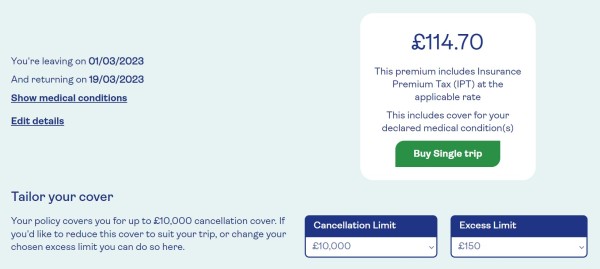

For our trip, our two travelers aged 62 are going to France on March 1, 2023 – March 19, 2023.

After entering all the details of the trip and listing any pre-existing medical conditions (in minute detail) are we taken to the purchase page. However, not until you get to the purchase page does it tell you that you must have your primary home in the UK and that your trip must start and stop in the UK!

Therefore, this insurance won’t work for US travelers going TO the UK or Europe. For US residents traveling overseas, we recommend shopping at a marketplace like TripInsure101 which will provide you with options for travel insurance policies enabling you to choose a policy that will give you the coverage you want for your travel needs.

For UK residents looking for travel insurance from SAGA, let’s look at what their policy provides.

SAGA Travel Insurance – Policy

For UK residents who choose to purchase SAGA insurance, either a single-trip or multi-trip policy is available. The single-trip SAGA travel insurance offers the customer a 14-day free-look period, also known as a cooling-off period.

SAGA Travel Insurance - Coverage

When we turn to the coverage limits, we see the cancellation limit is £10,000. This may be sufficient for many travelers, but there will be some for whom this limit is insufficient for their travel needs and may not provide sufficient coverage for the trip they have booked.

The medical and associated expenses coverage is £10 million. This would seem to provide a substantial level of cover that we would be happy to support. Additional coverage includes £2m of personal liability and £50,000 of legal expenses.

SAGA Travel Insurance – Job Loss (Redundancy)

Cover for loss of job is included, although the wording is quite restrictive. Note that there is no specified minimum period that a person must have worked with their employer. This should not be taken as meaning that no minimum period exists. The policy states that cover is for redundancy and that:

“you or your travelling companion have been given a notice of redundancy and are receiving payment under the current redundancy payments legislation”

The UK legislation on redundancy requires an employee to have worked continuously for their employer for two years before they are entitled to receive payments under the redundancy legislation.

This means that although the SAGA Travel Insurance doesn’t specifically state it in so many words, they require a customer to have been continuously employed for two years before being able to gain cover for loss of job under a SAGA travel insurance plan. This is slightly more restrictive than the normal 12 months continuous employment that we like to see in a travel insurance plan.

SAGA Travel Insurance – Medical Care

When we turn to the section of coverage dealing with medical and associated expenses, the first paragraph of the policy immediately looks restrictive.

“What is covered. This section provides insurance for medical and associated costs not covered by the National Health Service or any reciprocal health agreement. This is not private medical insurance.”

The policy speaks in terms of expenses not covered by the National Health Service (NHS) or by a “reciprocal health agreement”. What this appears to mean is that private hospitals and private associated costs are not covered within the United Kingdom or Europe.

This is on the basis that the NHS covers all medical and associated costs for a UK citizen, and that within Europe, there exist reciprocal arrangements so that each other European country's own health service will be provided to a UK citizen for free, or at a substantial discount, and the UK will act in a similar manner to citizens of other European countries if they need medical assistance whilst in the UK.

It is hard to envision a scenario where a UK citizen traveling in Europe or the UK could ever possibly incur medical and associated costs against their insurance plan. Every medical issue they might have would be covered by the NHS in the UK, or the equivalent within other member states. However, where a traveler is heading further afield than the UK and EU, such as a trip to the USA or Canada, then we see the true benefit of the medical cover coming into play. Imagine being taken ill on a trip to the USA. The costs of medical services, hospital procedures and repatriation back to the UK could quickly mount up.

SAGA Travel Insurance – Pre-existing Conditions

It is possible to cover a pre-existing condition with SAGA Travel Insurance, but any condition must be specified in great detail when buying the travel insurance, and you must continue to inform SAGA if your pre-existing condition changes prior to departure. There is no pre-existing condition waiver.

SAGA Travel Insurance also does not provide the customer with a time-sensitive period to purchase their insurance following initial trip payment to unlock any additional travel insurance benefits – for example, pre-existing condition waiver.

Pre-existing condition waiver is a term used where the normal exclusion that would prevent a traveler with a pre-existing condition getting cover being waived. Typically, with this type of waiver the traveler must be medically fit and stable when the travel policy is bought and needs to buy the travel insurance within a prescribed number of days following the initial trip payment date.

SAGA Travel Insurance – Single Trip Price Comparison

Next let’s turn to the price of the insurance.

Without anything to compare against, our travelers have no idea whether the product and price being offered represents good value and coverage, or whether they may be paying far too much for what may be inferior coverage. Only when we compare and contrast in the travel insurance marketplace will we discover the quality of the plan that SAGA offers.

Interestingly, when filling out the quote, we were not asked about cost of the trip. Having added all of these trip and personal details into the SAGA website, the price offered by SAGA for their single-trip travel insurance was £114.70.

To enable us to compare whether the SAGA travel insurance plan offers good or bad value and cover for money, we ran the same quote criteria through a UK travel insurance comparison website, similar to TripInsure101. The travel insurance comparison site came up with over 60 options of alternative coverage and listed them from cheapest to most expensive. The user then has the ability to sort by various headings, including rating and cover.

SAGA Travel Insurance – Travel Insurance Marketplace

As we have seen time and time again when reviewing single travel insurance products offered by airlines, member organizations and travel agents, the price of coverage available from a travel insurance comparison website was substantially lower for policies that were equal to or higher than that offered by SAGA.

However, to ensure that we are comparing like for like coverage, we filtered the results by the rating, to ensure that we only viewed insurance plans that offered the same 5-star Defaqto (similar to AM Best in the US) rating.

With this filter in place, we were able to see a true comparison of the alternative plans available on the open market versus the single-trip plan offered by the SAGA website and can make a better-informed decision as to the best travel insurance policy for our needs.

This is no surprise to us at TripInsure101. We know that a travel insurance marketplace like the one used in this example is the best way to find great value and coverage for a traveler. That is why we built TripInsure101, to quickly and easily give our customers the ability to compare and contrast multiple insurance plans in one easy-to-use website.

In summary, if you are a SAGA member looking to buy travel insurance, our advice is to use a comparison marketplace where you can compare multiple travel insurance plans from many of the largest providers. This will allow you to compare the product and price offered to you by SAGA and decide which travel insurance plan offers you best value and cover.

For US travelers looking for travel insurance, we encourage you to run a quote at TripInsure101 and compare leading US-based travel insurance companies.

Safe travels!

This article has been written for review purposes only and does not suggest sponsorship or endorsement of AARDY by the trademark owner.

Recent AARDY Travel Insurance Customer Reviews

customer

Great for comparing options

I have used TripInsure101 twice, and am very happy with them. They make it very easy to compare the different insurance companies and options.

Valued Customer

Great site

Great site, easy to navigate, comprehensive plan offerings

Cheryl Wentz

Efficient and…

Shauna was very efficient and knowledgeable. Made the purchase easy.